Tokenomics Series: Capped Vs. Uncapped Token Supply — Which Is More Beneficial For A Layer One Economy?

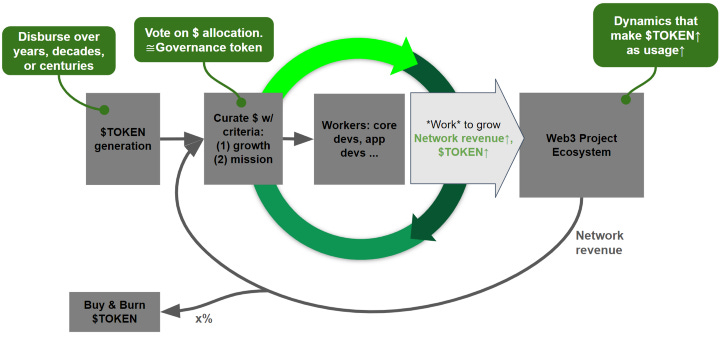

The design of crypto economies is the constant evaluation of tradeoffs between different models and scenarios. When examining crypto token supply schedules, it is often best to implement systems that the designs implemented to ensure sustainability per the Web 3 Sustainability Loop. The Loop, as described by Trent McConaghy (2020), is as follows:

The community proposes and curates projects.

Network revenue and Network reward are used to fund projects.

As projects *work* and add value, network revenue, and $TOKEN rise, and more money flows to the community.

Hence, several factors must be considered while examining the merits and demerits of a capped or uncapped token supply for a layer one blockchain. In this essay, I will highlight some key differentiators between the capped and uncapped token supply and some key factors I consider when deciding between both token supply mechanisms. In choosing between an uncapped or capped token supply, there are three key factors I prioritize:

The existence of faucets and sinks

Financing options available

Market conditions and pricing dynamics

The existence of faucets and sinks

While designing the tokenomics of a layer one blockchain, there needs to be adequate consideration given to the implementation of faucets and sinks across the network. A study by Jarvis Labs (2020) highlights that “game economies need to balance the number of faucets, or ways for money to enter the game, and sinks, or ways for money to disappear.”

For a layer one blockchain, the faucets into the ecosystem can be token mints and other such events, while the burning fees and incentivizing staking, to name a few, can serve as sinks. To maintain price stability and confidence in the currency issued by the layer one, there needs to be an equilibrium between faucet inflow and sink outflows.

Financing options available

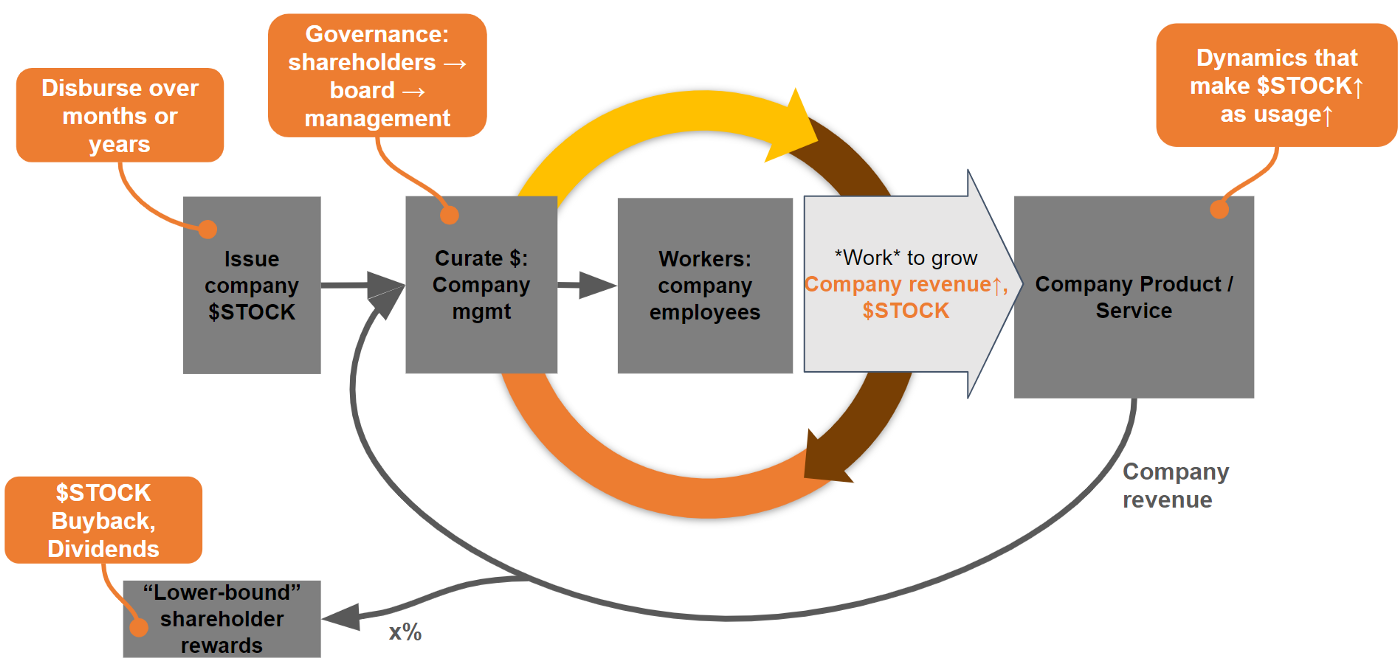

In deciding between an uncapped and capped token supply mechanism for any layer one, we must examine the financing options available to the protocol to undertake growth projects and expand the chain capabilities. For example, in Web 2, companies can raise financing via stock sales or shares when publicly listed.

Luckily, this feature is inherently embedded into Web 3 models as protocols can issue tokens and receive funds to undertake development projects.

Alternatively, layer one blockchains can rely exclusively on private investors to raise funds and expand while risking alienating consumers.

Market conditions and pricing dynamics

Launching a layer one blockchain in a bear or bull market can have different dynamics. For example, raising a VC round in a bear market at launch may signal retail and non-institutional investors that investors will dump the chain's token at launch. Similarly, minting tokens in a bear market to raise capital can be terminal if the optics are wrong.

Now that I have highlighted the three most important factors I considered while deciding between a capped and uncapped token supply, I will highlight the pros and cons of each supply mechanism in light of the above factors.

Capped Token Supply

Tokens with a capped token supply have a maximum number of tokens that can be minted into circulation. This has been the favored token launch mechanism. Blockchains like Polygon, Avalanche, Algorand, Fantom, and Binance Smart Chain have capped their token supply. This is beneficial to the price of the chain's token.

Pros

A capped token supply can be especially beneficial if the layer one has access to deep levels of private financing. For example, we can see the large funding rounds chains like polygon, avalanche, and binance smart chain have recently raised.

Cons

The blockchain may be viewed as serving the interests of venture capitalists who will sell tokens at given opportunities to turn a profit.

Suppose there is a scare amongst private capital allocators by events such as the dot-com bubble burst or the 2008 financial crisis. In that case, the chain will not be able to issue new tokens to raise from retail or non-institutional investors.

Uncapped Token Supply

An uncapped token supply means that the layer one blockchain can issue tokens at will, depending on the conditions or as outlined by the protocol's governance. For example, this is the token supply mechanism used by chains like Cosmos and Solana.

Pros

Tokens can serve as a crucial financing lifeline when the blockchain cannot raise funding from private capital allocators.

The chain can drive true financial inclusion in the economy by conducting public sales giving participants a sense of ownership and an incentive to contribute to the growth of the protocol.

An uncapped token supply will allow the blockchain to continue to raise funds while pivoting and finding product-market fit.

Cons

Poorly planned token emissions can be fatal to user adoption and development of the chain.

Recommendations

I sometimes refer to layer one blockchains as sovereign chains. This is because we can view layer one blockchains as economies that have jurisdiction over the protocols and projects established on the blockchain.

Once you start to view layer ones as developing digital economies, it makes sense that the chain should have maximum control of the financing options available to expand the blockchain. With that said, I recommend that new layer one networks opt for an uncapped token launch.

However, the blockchain must have a well-defined genesis token generation event. In addition, there must be some well-defined parameters to inform investors on factors like the initial inflation rate, the disinflation rate, and the long-term inflation rate.

An uncapped token launch and strategic token emissions can promote the incentive design of the crypto-economy that will develop on any emerging layer one, ensuring that participants are invested in the chain's success

To ensure the success of a layer one network in an uncapped token supply model, I will recommend the following:

The inflation rates of the token must be in tandem with the actual growth rates seen on the blockchain over time. There must be an equilibrium.

The layer one team must institute a unit responsible for designing and monitoring the monetary policy of the blockchain. In addition, the team must ensure the sinks' growth to absorb the inflationary pressures caused by the inflows from the faucets.

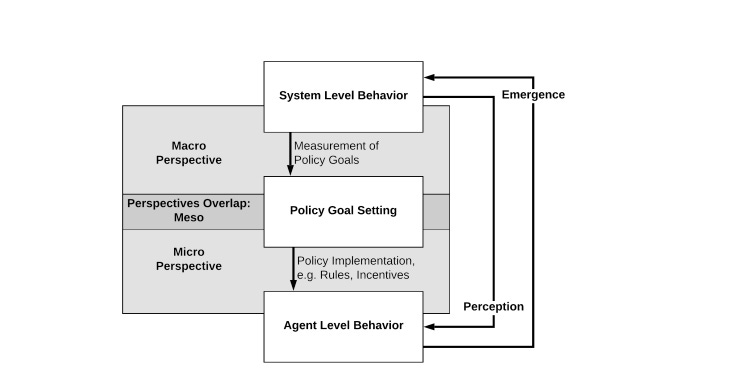

Finally, I will implore the use of modeling tools like machinations to play out the outcomes for a capped and uncapped token supply mechanism, thoroughly considering the macro, meso, and micro perspectives of participants using the emerging layer one network blockchain.

This will allow for better forecasting and predictions of both options' outcomes and how it can serve in the best interest of an emerging Layer one and digital economy.

If you have other thoughts, please contact me on Twitter, I always love a healthy debate.

Resources

Voshmgir, S., & Zargham, M. (2020). Foundations of Cryptoeconomic Systems. (Working Paper Series / Institute for Cryptoeconomics / Interdisciplinary Research; No. 1). WU Vienna University of Economics and Business.

Trent McConaghy (2020). The Web3 Sustainability Loop https://blog.oceanprotocol.com/the-web3-sustainability-loop-b2a4097a36e

Jarvis Labs (2022). Insights on Token Design - Case Study: Axie Infinity